Benz Drops Insights

Stay updated with the latest news and trends in the automotive industry.

Cash in a Flash: The Rise of Instant Payout Systems

Discover how instant payout systems are revolutionizing finance! Learn the secrets to getting cash fast and navigating this digital goldmine.

Exploring Instant Payout Systems: How They Transform E-Commerce Transactions

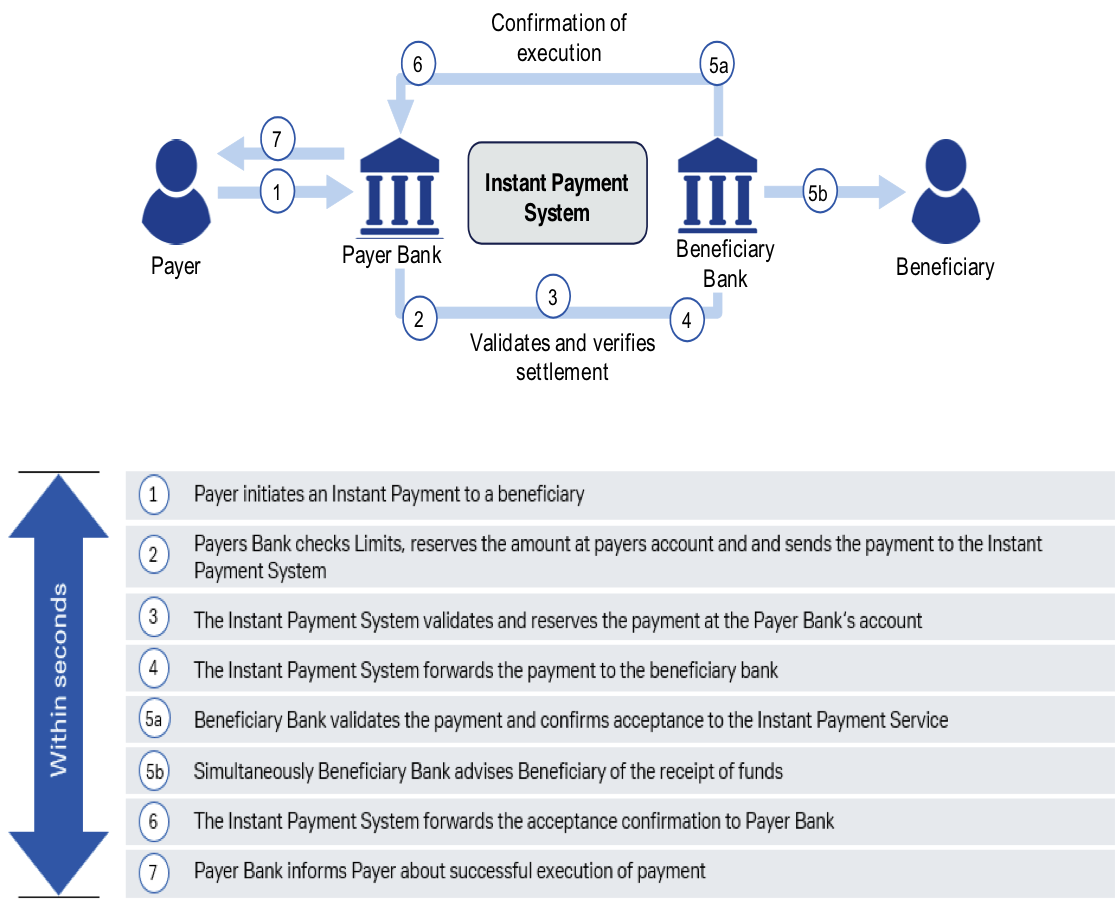

In today’s fast-paced digital marketplace, instant payout systems are revolutionizing the way e-commerce transactions are handled. These systems allow merchants to receive payments immediately after a sale is made, eliminating the traditional waiting period that can stretch from several days to weeks. This rapid access to funds not only enhances cash flow but also empowers sellers to reinvest in their businesses quickly. By leveraging advanced technologies, such as blockchain and real-time payment processing, these systems ensure secure and efficient transactions that benefit both merchants and consumers.

The rise of instant payout systems has also transformed customer expectations. With instant payment options, consumers are more likely to complete a purchase, knowing that the seller will receive their payment promptly. Moreover, these systems offer a range of features tailored to enhance user experience, such as easy integration with existing e-commerce platforms, automated reconciliation, and transparent transaction tracking. As more businesses adopt these innovative solutions, the potential for increased sales and improved customer satisfaction becomes a reality, marking a significant shift in the future of online commerce.

Counter-Strike is a highly competitive first-person shooter game where players join either the terrorist or counter-terrorist team to complete objectives. The game emphasizes teamwork, strategy, and skill, providing an engaging experience for both casual players and professionals alike. You can enhance your gameplay by using the clash promo code for in-game rewards.

The Benefits of Instant Payouts: Why Businesses are Making the Switch

In today's fast-paced business environment, the demand for instant payouts is growing rapidly. Companies are realizing that offering instant payment options not only boosts employee satisfaction but also enhances customer loyalty. By enabling workers to access their wages immediately after completing a job or transaction, businesses can foster a sense of trust and fulfillment, effectively reducing turnover rates. With the convenience of digital wallets and mobile payment platforms, instant payouts create a seamless experience that attracts top talent and keeps customers coming back.

Furthermore, switching to instant payouts can lead to improved cash flow management. By reducing the waiting period for payments, businesses can minimize the financial strain typically associated with invoicing and payment processing delays. This is particularly beneficial for small and medium-sized enterprises (SMEs) that rely heavily on consistent cash flow to maintain operations. Overall, the transition to instant payouts not only improves operational efficiency but also positions businesses to compete more effectively in an increasingly digital marketplace.

What You Need to Know About Instant Payouts: FAQs Answered

Instant payouts have become increasingly popular among freelancers, gig workers, and businesses looking for quick access to their earnings. Many platforms now offer this feature, allowing users to receive their funds almost immediately after a transaction is completed. However, understanding the nuances of instant payouts can be challenging. In this article, we’ll answer some frequently asked questions about instant payouts to help clarify any confusion.

One common question is, How do instant payouts work? Generally, platforms facilitate instant payouts by utilizing digital payment systems that enable real-time transactions. Users simply select the instant payout option, and the funds are transferred directly to their bank account or digital wallet, often within minutes. It's also important to note that some platforms may charge a fee for this service, so make sure to review the payment terms before opting for instant payouts.